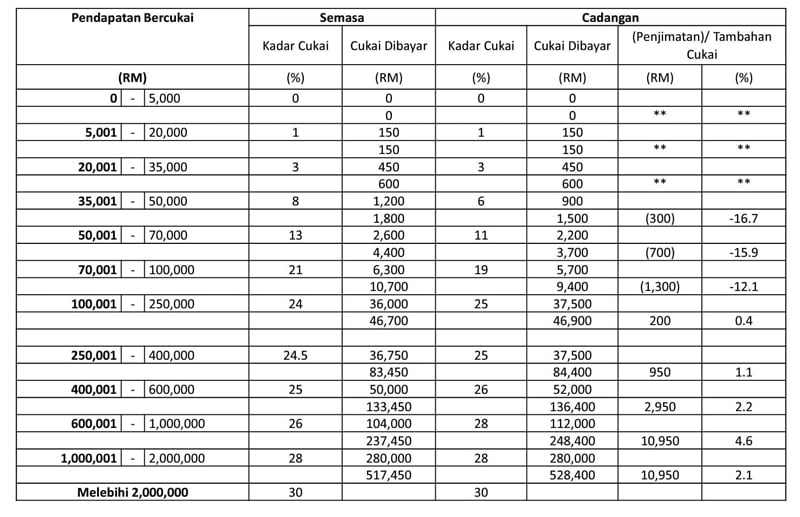

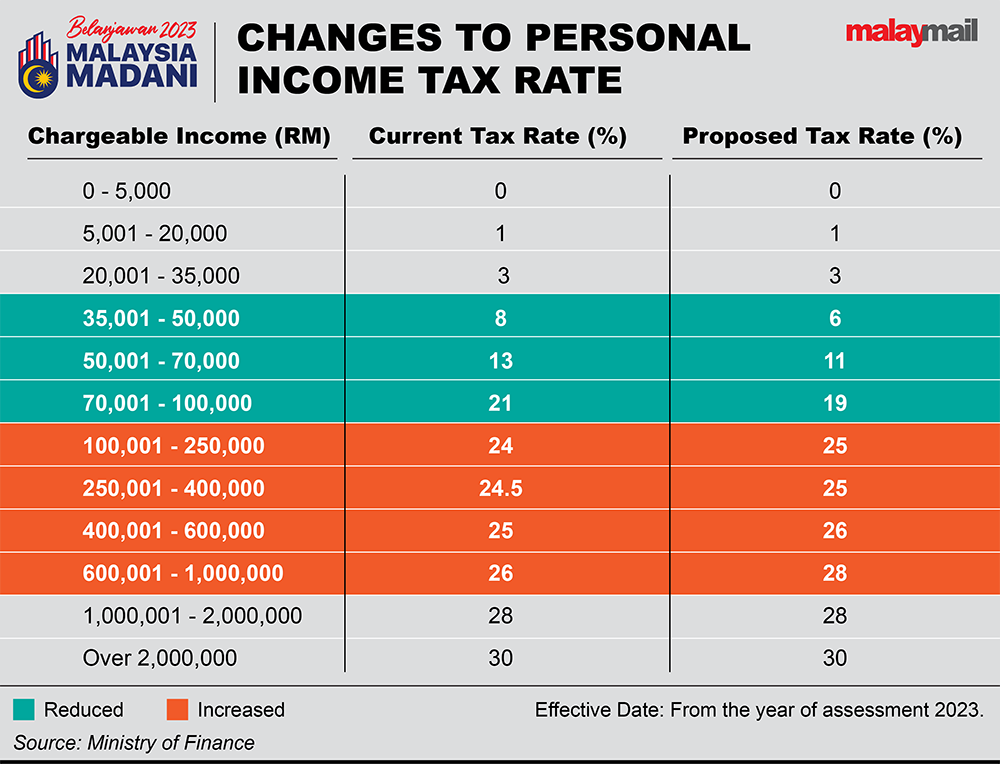

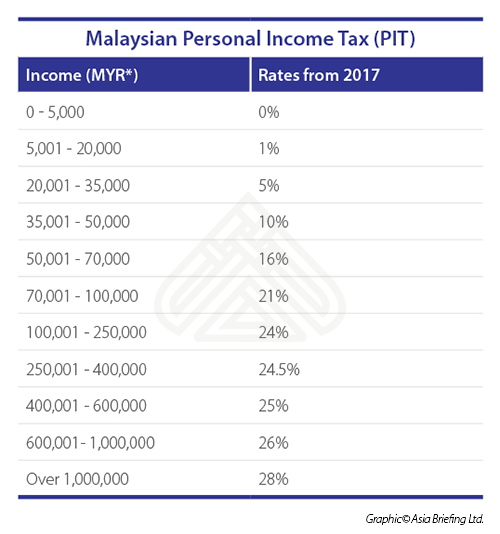

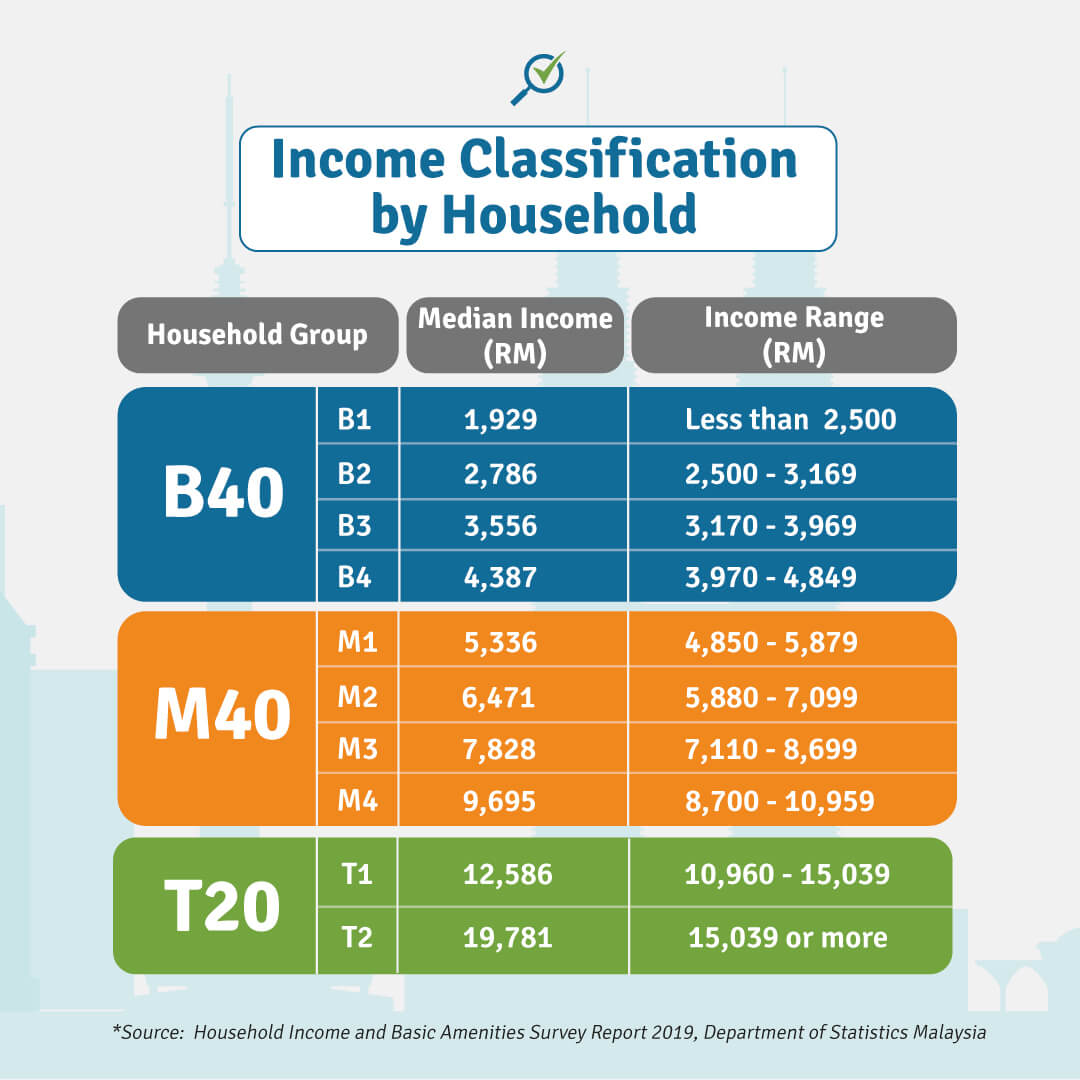

Tax Brackets For 2025 Malaysia 2025. Malaysia has a tiered tax rate system according to income brackets. The income tax rates for resident individuals are structured into tax brackets.

Malaysia Tax Bracket 2025 Myra Yolanda, Restriction on deductibility of interest [section 140c, income tax act 1967] international affairs;

Tax Brackets For 2025 Malaysia Trix Alameda, Average lending rate bank negara malaysia schedule section 140b;

Malaysian Tax Bracket 2025 Alana Augusta, Ibu pejabat lembaga hasil dalam negeri malaysia, menara hasil, persiaran rimba permai, cyber 8, 63000 cyberjaya selangor.

Malaysia Tax Bracket 2025 Prue Ursala, Restriction on deductibility of interest [section 140c, income tax act 1967] international affairs;

Tax Brackets 2025 Malaysia Alyce Bernice, An individual is regarded as tax resident if he meets any of the following conditions, i.e.

Malaysian Tax Bracket 2025 Alana Augusta, How much income tax you pay depends on your tax rate.

Tax Rate Bracket 2025 Loree Ranique, The rm 20,000.00 figure defined is taxable income, not an annual gross salary.

2025 Tax Brackets Taxed Right, This tool is designed for simplicity and ease of use, focusing solely on income tax calculations.

Individual Tax Rates 2025 Malaysia Lynn Sondra, This infographic sets out the key tax developments and.